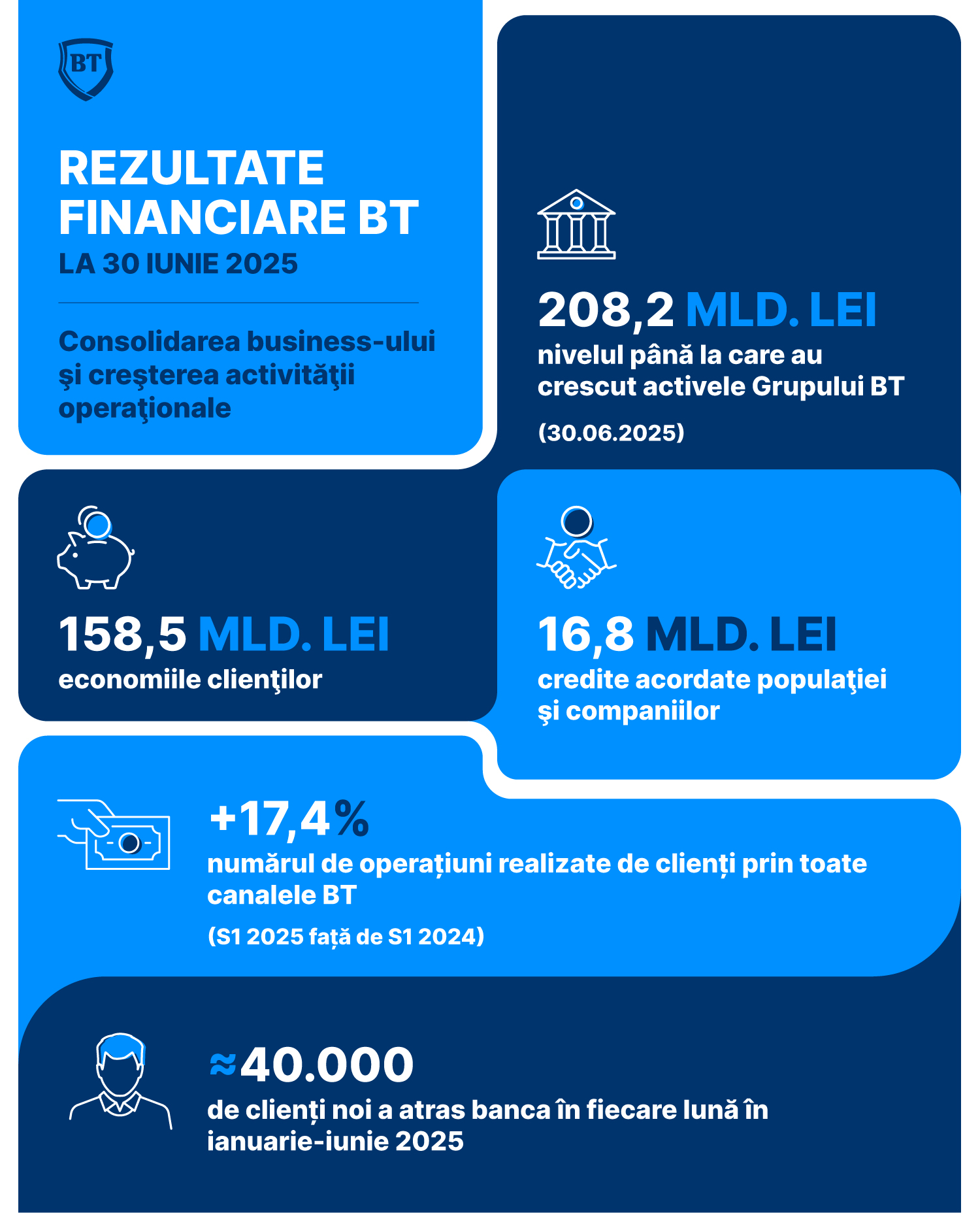

In line with BT's 2025 financial reporting timetable, we are releasing our results for the first six months of the year to keep customers, investors, shareholders and partners up to date with the financial performance of the bank and BT Group. The business strengthened and operational activity increased in the first six months of the year.

BT growth drivers in the first half of the year

- The bank has been steadily rolling out functionality in BT Pay (for the general public) and BT GO (for entrepreneurs).

- BT has reached over 5.2 million unique cards in digital wallets and the number of phone payments is +30% to 150 million (H1 2025 vs H1 2024).

- The bank has increased its customer base - including through the merger with OTP Bank Romania - to 4.84 million individual and corporate customers as of June 30, 2025 The bank attracted, on average, more than 40,000 new customers each month in January-June 2025.

- The portfolio of net loans and receivables from leasing, at consolidated level, is +4.5% (vs. 31.12.2024) and +28% (H1 2025 vs. H1 2024), reaching RON 100.7 billion.

- BT financed companies with RON 9.7 billion, supporting mainly infrastructure, health, agriculture and energy projects.

- 7.1 billion lei represent the loans granted by banks to the population, of which 46% are real estate/mortgages, 54% are consumer loans without mortgage or other types of financing for personal needs.

- Our customers' savings amounted to RON 158.5 billion (+5.1% vs. 31.12.2024, respectively +14% in H1 2025 vs. H1 2024).

Banca Transilvania Group's net profit amounted to RON 1.97 billion at the end of June 2025, out of which the bank's net profit amounted to RON 1.78 billion.

Interested in more details about BT's performance in the first half of the year? It's waiting for you here.