After analyzingthe economic relations between Romania and Hungary in October 2025 ( ), we now turn our attention to Austria. The context for this analysis is provided by two events taking place in Vienna in January 2026. The first is organized by Banca Transilvania Group and the Romanian Embassy in Austria, Connecting Growth – Investing in Romania. The second, The Central & Eastern European Forum - Where CEE Markets Thrive, is a Financial Times event, during which BT is organizing and supporting the panel Focus Romania.

Austria, the second largest investor in Romania

Austria is a strategic economic partner for Romania. Austrian investments are mainly concentrated in energy, banking, industry, infrastructure, and services, areas that directly influence the competitiveness of the Romanian economy. Austria is the second largest foreign investor in Romania, after Germany.

Cooperation between Romania and Austria is based on economic interdependence, constant trade exchanges, and a dynamic entrepreneurial environment, amplified by their shared membership in the European Union and the Schengen Area. This favorable context stimulates regional cooperation and strengthens strategic partnerships, transforming the Romanian-Austrian relationship into a pillar of European integration.

The two countries are also connected by the large Romanian community in Austria, which contributes significantly to the Austrian economy and society.

Bilateral trade

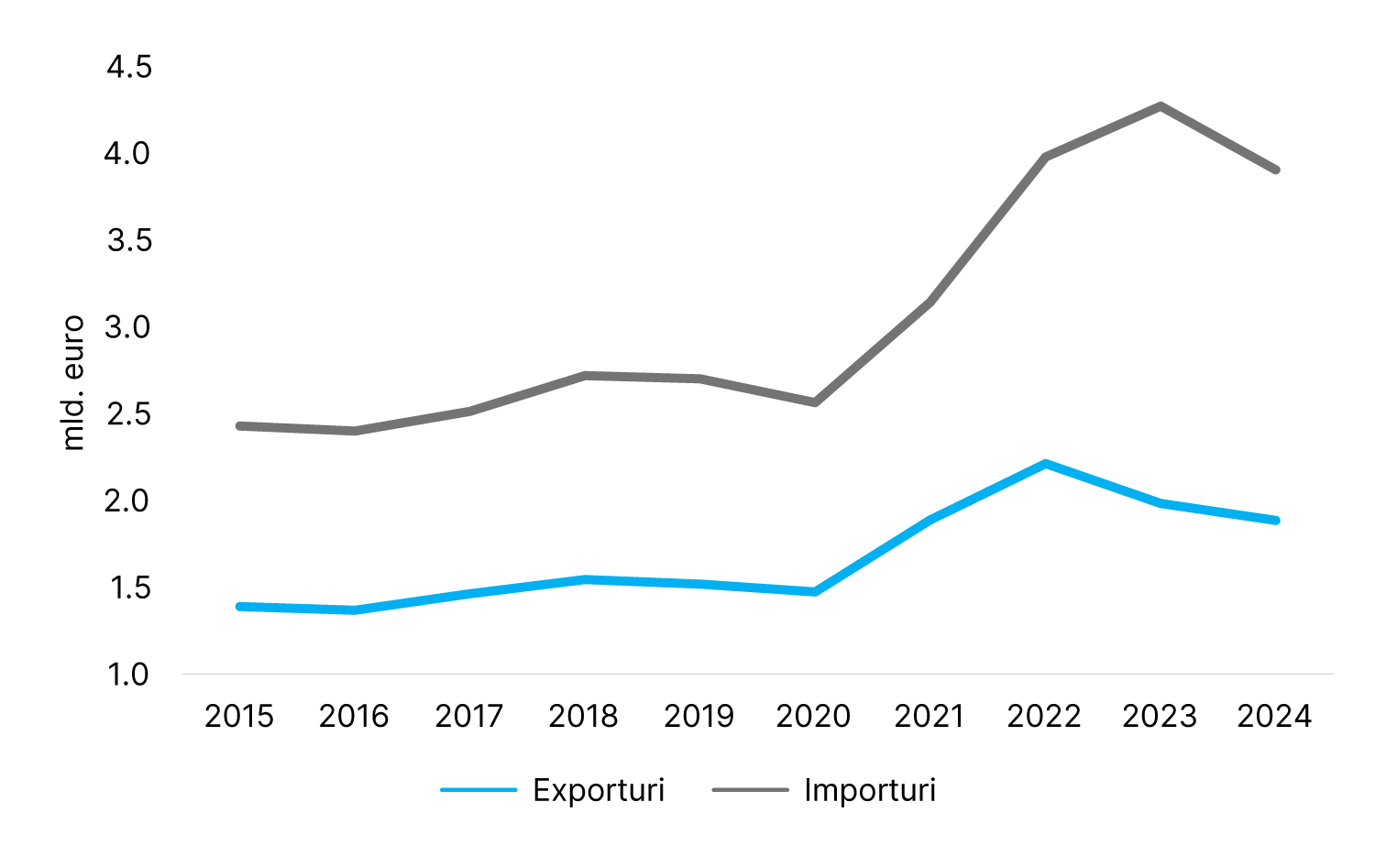

Over the past ten years, Romania has had a negative trade balance with Austria, importing on average €1.4 billion more per year than it exported.

The year 2023 marked a record level of bilateral trade (€6.3 billion), which was driven by a combination of factors, including a strong recovery from the COVID-19 pandemic and solid economic growth in both countries.

Trade symmetry: according to INS data, the most exported product categories from Romania to Austria over the last ten years were:

- Machinery, appliances, and electrical equipment (€0.6 billion in 2024; 32% of total exports)

- Transportation means and materials (€0.3 billion in 2024)

- Base metals and articles thereof (€0.2 billion in 2024)

Of the three categories, transportation equipment and materials have seen steady growth in recent years, increasing by 4.2% in 2024 compared to the previous year. Romanian brands such as Dacia (Renault Group - motor vehicles) and Softronic (locomotives) report an increase in their presence on the Austrian market. Dacia achieved a 4.2% market share in Austria, with sales increasing by 13.2% in 2024 compared to 2023. Austria is the fifth EU country in terms of Dacia's market share in the passenger car market, after Portugal, Italy, Belgium, and Luxembourg.

The same three categories of goods are also the most imported by Romania from Austria, highlighting the close link between the two economies. On the one hand, this is explained by the fact that both countries have a strong presence in these areas. On the other hand, the strong presence of Austrian investors in Romania means that part of Romania's exports are produced by subsidiaries of Austrian companies in Romania, creating a circular trade flow. The symmetry of trade also highlights the existence of integrated supply chains and cross-border specialization beyond the subsidiaries of companies in one country in the other country, so that for the same product, the components are manufactured in one country, assembled in another, and then shipped back as finished or semi-finished products.

In the coming period, trade between the two countries is expected to increase as a result of Romania's accession to the Schengen area, which facilitates cross-border trade in goods by reducing transport time and, implicitly, costs.

Evolution of bilateral trade between Romania and Austria in 2015-2024

Of the nearly 13,000 Austrian companies with subsidiaries in the EU, over 10% are in Romania.

In 2024, Austrian companies held investments worth €14 billion, either directly or through subsidiaries and branches in intermediary countries, representing 11.3% of the total balance of foreign direct investment in our country. Of the nearly 13,000 Austrian companies with subsidiaries in European Union countries, over 10% are located in Romania.

Among the best-known Austrian-owned companies in our country are: OMV Petrom, BCR Erste Group, Raiffeisen Bank, Vienna Insurance Group, Porsche Romania, Julius Meinl, Pfanner, Swarovski, and Hervis Sports. A strong presence on the Romanian market can also be seen in the construction (Strabag, Porr), real estate (Immofinanz), and wood and furniture processing (Egger, Kronospan, XXXLutz) sectors.

In addition to the goods and services these companies bring to the Romanian market, the subsidiaries of Austrian companies contribute to Romania's prosperity through local labor. Austrian companies have nearly 100,000 employees in our country and pay approximately €1.9 billion annually in salaries, taxes, and related benefits.

The Austrian market is also becoming attractive for a number of Romanian companies, especially in the IT sector. For example, Teraplast acquired the Austrian company Wolfgang Freiler in 2024.

Interregional projects supported by European funds

Romania and Austria are part of a series of projects co-financed by interregional development funds. These projects cover a wide range of activities, such as technological innovation, sustainable development, modernization of transport systems, improvement of institutional capacity, and increased interregional cooperation.

For example, the Danube Transnational Program was a partnership between nine EU countries, running from 2014 to 2020. One of its four priorities was to create new inland waterways or improve existing ones, ports, and multimodal connections to support sustainable local and regional mobility, modal integration, and smart transport.

During the 2021-2027 funding period, Romania and Austria are partners in a series of interregional projects, such as Urbact IV, focused on increasing interest in small and medium-sized cities and encouraging the dual transition (green and digital) to support competitiveness and sustainability.

The Romanian Diaspora in Austria

- Romanians are the second largest category of EU immigrants in Austria after Germans, numbering almost 150,000.

- Every year, approximately 22,000 Romanians emigrate to Austria.

Economic relations between Romania and Austria are taking shape as a solid strategic partnership, built on consistent investments, dynamic trade exchanges, and interdependence between the two economies. Although the trade balance remains negative for Romania, the upward trend in sectors such as transportation and IT shows the potential for balancing and diversifying bilateral flows.

Austria is consolidating its position as a major investor in Romania, contributing not only to the development of infrastructure and industry, but also to job creation and the integration of the Romanian economy into European production chains. At the same time, Romanian companies are beginning to make their presence felt more and more on the Austrian market. Romania's inclusion in the Schengen Area will amplify these links, reducing logistical barriers and trade costs, and will open up new opportunities for regional cooperation.